The Mary A. Rackham Institute (MARI) at the University of Michigan was established in the late 1930s to provide human services to those in the university and surrounding community. MARI is committed to serving clients who are residents of Michigan and cannot obtain clinically necessary services because of an inability to pay. Our Financial Assistance Policy enables these clients to apply for assistance.

This policy also includes provisions for clients at the University Center for Language and Literacy (UCLL) who are not residents of Michigan to apply for a more limited level of financial assistance (see below).

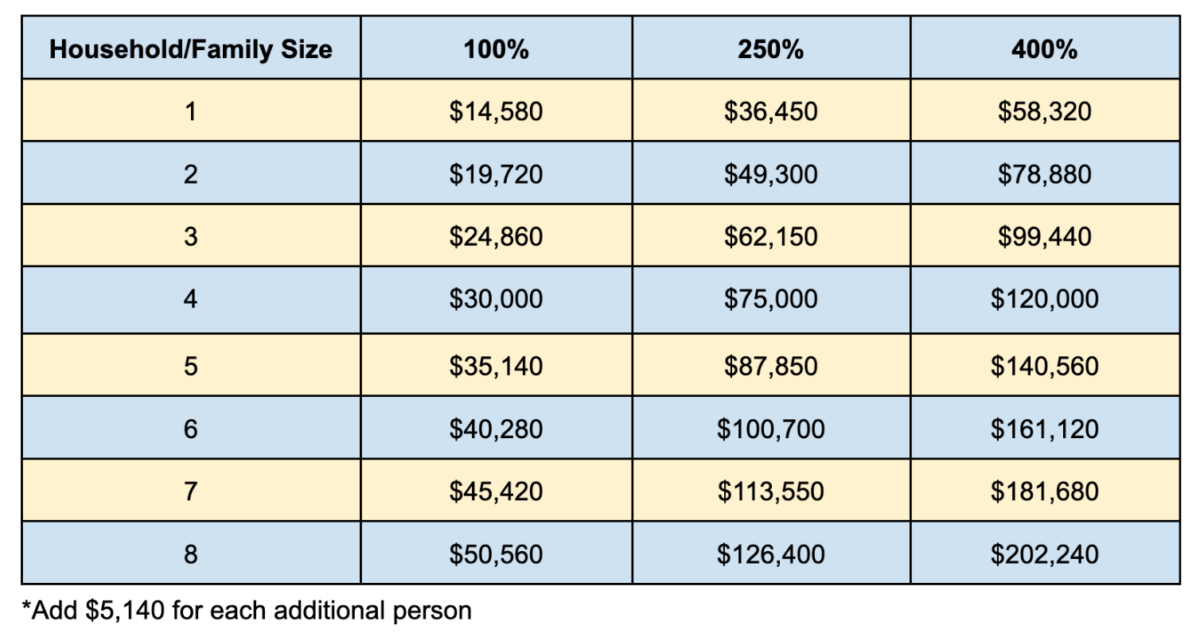

For clients who are Michigan residents, a client may receive a 60% reduction of the cost of services if their income does not exceed 250% of the Federal Poverty Guidelines and meets other criteria for assistance. A client may receive a 40% reduction of the cost of their services if their household income is between 250% and 400% of the federal poverty guidelines and meets other criteria for assistance.

In order to meet the criteria for financial assistance, a client:

- Must complete a MARI Financial Assistance Application online. The application will open in a new tab and is secure.

- NOTE: If you’d like a version that you can download and print and then fax or mail to MARI, click here: MARI Financial Assistance Application Paper Version (PDF).

- If you would like a paper version mailed to you, please contact MARI via the digital form or call us at (734) 615-7853.

- The applicant’s liquid assets may not exceed not 2.5 times the total fees for the approved time period with the following exception: The client may have up to $100,000 in a retirement account, I.R.A., T.S.A., or 401K.

- Must have a household income less than 400% of the federal poverty guidelines set forth each year.

- Can not be enrolled in a college or university.

- Must be a resident of Michigan to be eligible for any fee reduction at the University Center for the Child and Family (UCCF) and the University Psychological Clinic (Psych Clinic).

- Must be a resident of Michigan to be eligible for the full reductions at UCLL. Non-Michigan resident clients of UCLL may qualify for:

- A 40% adjustment of charges if the client’s household income does not exceed 250% of the established federal poverty level guidelines set forth for the current year.

- A 25% adjustment of charges if the client’s household income is between 250% and 400% of the established Federal Poverty Level guidelines set forth for the current year.

- If the applicant is seeking a fee reduction for services at UCCF or the Psych Clinic, the applicant must have applied for either Medicaid or an insurance plan on the health insurance exchange and been denied.

- Clients who would qualify financially for Medicaid or insurance coverage may qualify for a fee adjustment related to clinically necessary non-covered services, co-pays and deductibles based on the income guidelines and other criteria listed above.

- MARI has a contractual obligation to collect the allowable co-insurance and deductible amounts. However, a client may be granted Financial Assistance for residual balances after insurance if a case can be made for financial hardship. The financial assistance will be provided in keeping with the criteria listed above

- May qualify for clinically necessary services that are not covered under their Medicaid and County Health Plan

- When eligible for COBRA* benefits, declined to pay for coverage because the cost is greater than 25% of their monthly income

If you’d like this information in a document form, you can download it here: MARI Financial Assistance Overview with Federal Poverty Guidelines.

* COBRA gives workers and their families who lose their health benefits the right to choose to continue health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. (www.dol.gov)

Financial Assistance Application

Click the button below to begin the application. Please note that you will need your most recent year tax information, a recent paystub, an image of your identification, and banking documents to complete the application. If you are married, you will also need copies of your spouse's financial information to upload.

Online ApplicationIf You Have Questions

We’re Happy to Answer Them!

Please contact us at (734) 615-7853 from 8 a.m. to 4 p.m. (EST) Monday through Friday with questions about the form, requirements, or where to submit your materials.

2023 Federal Poverty Guidelines

Resources

- Download the MARI Financial Assistance Overview with Federal Guidelines.

- Online financial assistance application or a paper copy can be mailed to you by request, by contacting the MARI Call Center at (734) 615-7853.